An IBAN (International Bank Account Number) is a unique identifier for a bank account that helps facilitate cross-border transactions. It ensures that your payments are processed accurately and efficiently, especially when transferring funds internationally. Depending on your country and bank, you might need to know how to find your IBAN for making international payments or receiving funds. In this guide, you’ll learn the steps to easily locate your IBAN number and understand its structure. By the end of this article, you’ll be equipped with the knowledge to find your IBAN swiftly, ensuring smooth transactions.

What is an IBAN Number?

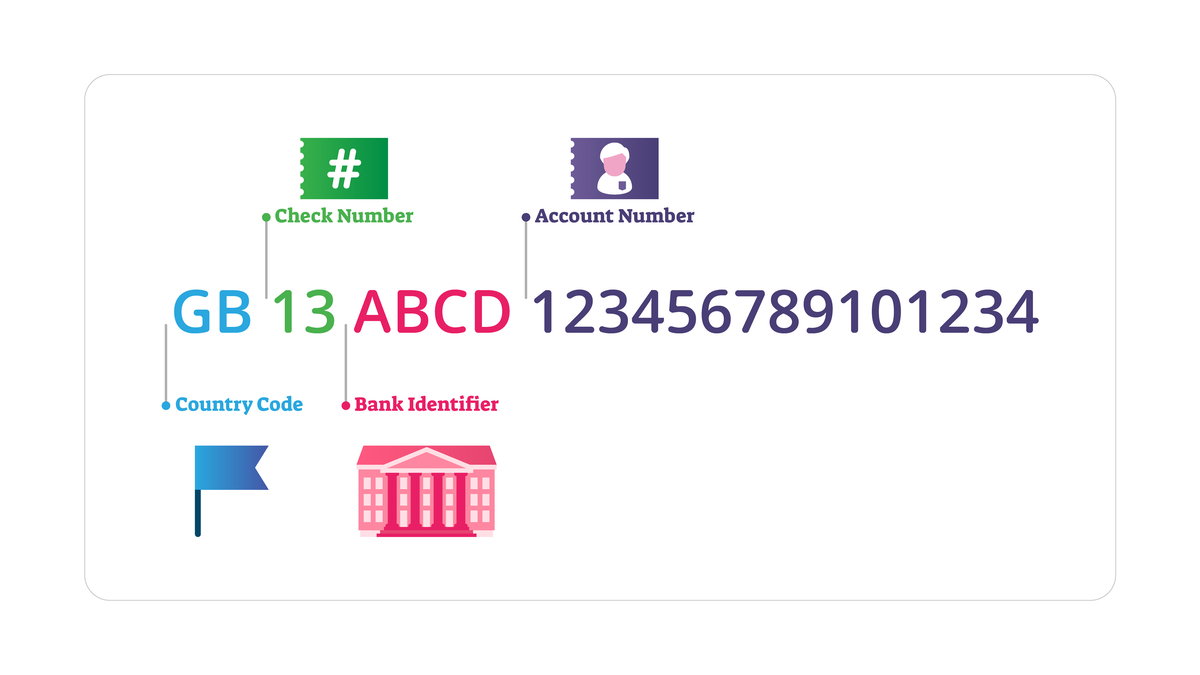

An IBAN is a standardized international system for identifying bank accounts across borders. It consists of up to 34 alphanumeric characters, which include a country code, check digits, bank code, and account number. The format of the IBAN varies from country to country, but it is designed to simplify the transfer of funds internationally. An IBAN eliminates the chances of errors in cross-border transactions by ensuring that banks and payment systems can accurately read the account details. Understanding the structure of your IBAN number is crucial for ensuring you provide the correct information for wire transfers and other payments.

How to Find Your IBAN on Bank Statements

The easiest way to find your IBAN is by checking your bank statements. Most banks print your IBAN number on your physical or electronic statements, typically near your account details. Look for a section labeled "IBAN" or "Account Number," where your unique identifier should be listed. If you don’t find it, you can always contact your bank for assistance in locating the number. Checking your statements is a quick way to find your IBAN without having to go through other methods.

Using Online Banking to Find Your IBAN

Online banking platforms usually provide a straightforward way to view your IBAN. Log in to your account, navigate to your account details, and look for a section labeled "IBAN" or "International Account Number." Many banks now display the IBAN directly alongside your account number for ease of reference. If your bank doesn’t list it explicitly, you might be able to generate the IBAN by using your account number and branch code through their online tools. This method is fast and accessible from anywhere, as long as you have internet access.

IBAN Generator Tools

If you cannot find your IBAN number in your bank statements or online banking, you can use an IBAN generator tool. These online tools allow you to generate an IBAN by entering your country, bank, and account number. Simply search for "IBAN generator" on Google, select a reliable tool, and enter the requested information. However, it’s important to ensure you’re using a secure and trustworthy generator, as incorrect information can lead to errors. IBAN generators are an excellent option if you have all the necessary account information but can’t find your IBAN directly.

Contacting Your Bank for Assistance

If you’re still having trouble locating your IBAN, your bank is always the best resource for assistance. Most banks are happy to provide you with your IBAN when requested. You can either call the customer service center or visit your local branch to ask for your IBAN number. Make sure to have your account details ready so the bank can quickly access your information. While this might take a little longer than other methods, it guarantees you get the correct IBAN information.

Vote

Who is your all-time favorite president?

Using the IBAN to Make International Transfers

Once you’ve found your IBAN number, it becomes essential for making international money transfers. You will need to provide the IBAN to the sending or receiving bank to complete the transaction. The IBAN is typically used in combination with the SWIFT/BIC code to ensure the money is routed correctly. Always double-check that the IBAN you provide is accurate, as mistakes can result in delays or misdirected payments. Knowing how to find and use your IBAN effectively is critical for international financial transactions.

Differences Between IBAN and SWIFT/BIC

It’s essential to understand the difference between an IBAN and a SWIFT/BIC code, especially when making international payments. While an IBAN is used to identify the specific bank account, a SWIFT/BIC code identifies the bank itself. You often need both the IBAN and SWIFT/BIC code to complete an international transfer successfully. The IBAN ensures the funds reach the right account, while the SWIFT/BIC code ensures the funds reach the correct bank. Understanding both codes ensures that your international transactions are smooth and efficient.

Mobile Banking Apps and IBAN

Most mobile banking apps now allow you to view your IBAN easily. Open your banking app and navigate to the section where your account information is displayed. Many apps show your IBAN as part of your account details or have a separate section for it. If your app does not display your IBAN, check the FAQs or help section to see if it’s available digitally. Mobile banking apps make it convenient to find your IBAN on the go, making international payments faster and easier.

Understanding IBAN Formats by Country

Different countries have different formats for their IBANs, with variations in the length of the number and the components included. For example, an IBAN in the UK typically has 22 characters, while an IBAN in Germany may be 22 characters long as well but with a different format. To ensure the correct IBAN, always check your bank’s guidelines on how to read and structure the number for your specific country. Many banks provide online guides that detail how to find your IBAN in the local format, making it easier to understand for international payments. Knowing these formats helps avoid mistakes when sharing your IBAN with others.

Methods to Find Your IBAN

- Check your physical or electronic bank statements.

- Log in to your online banking account and view account details.

- Use an IBAN generator tool online.

- Contact your bank’s customer service for assistance.

- Use your bank’s mobile app to find the IBAN.

- Look for your IBAN when setting up international transfers.

- Verify your IBAN format by checking your country’s guidelines.

Watch Live Sports Now!

Dont miss a single moment of your favorite sports. Tune in to live matches, exclusive coverage, and expert analysis.

Start watching top-tier sports action now!

Watch NowTips for Using Your IBAN

- Always double-check the IBAN before sharing it with others.

- Keep your IBAN confidential to prevent unauthorized transactions.

- Use your IBAN in conjunction with the SWIFT/BIC code for international payments.

- Ensure that your IBAN is valid before making transfers.

- Avoid sharing your IBAN on untrusted websites or platforms.

- Regularly review your bank statements to ensure the correct IBAN is listed.

- Store your IBAN securely for future reference when making payments.

Pro Tip: Some banks offer an option to set up international transfers directly using the IBAN in their mobile apps, saving you time and reducing the risk of errors.

| Method | Advantages | Best For |

| Bank Statements | Easy to find | Customers who prefer physical records |

| Online Banking | Quick and convenient | Tech-savvy users |

| IBAN Generator | Ideal when no IBAN is available | Users who have full account details |

“Having easy access to your IBAN ensures that your international payments are processed efficiently, reducing errors and delays.”

Now that you know how to find your IBAN number, it’s time to make sure you always have it accessible for international transactions. Whether you check your bank statements, log into online banking, or use a generator, knowing how to find your IBAN will make global payments smoother. Share this guide with anyone who might benefit from it, and bookmark it for quick access in the future. Be proactive with your financial tools and stay informed to avoid errors in your next transaction. Happy banking!